37+ Portfolio Standard Deviation Calculator

Web Standard deviation is equal to 1. Web To calculate the beta of a security or portfolio we divide covariance between the return of security and market return by the variance of the market return.

Standard Deviation And Risk

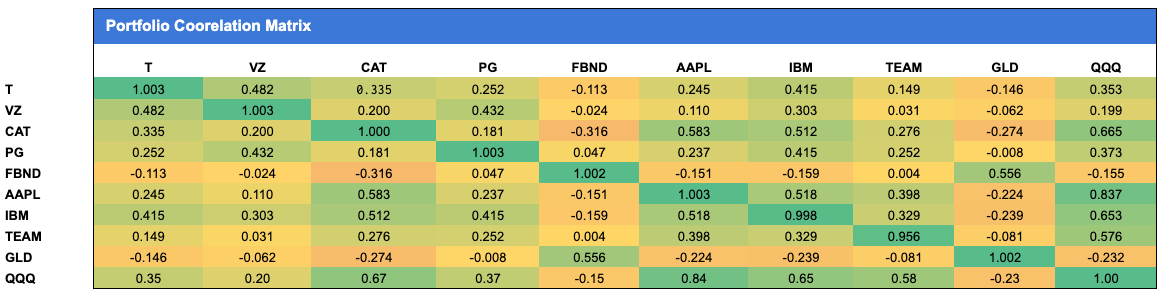

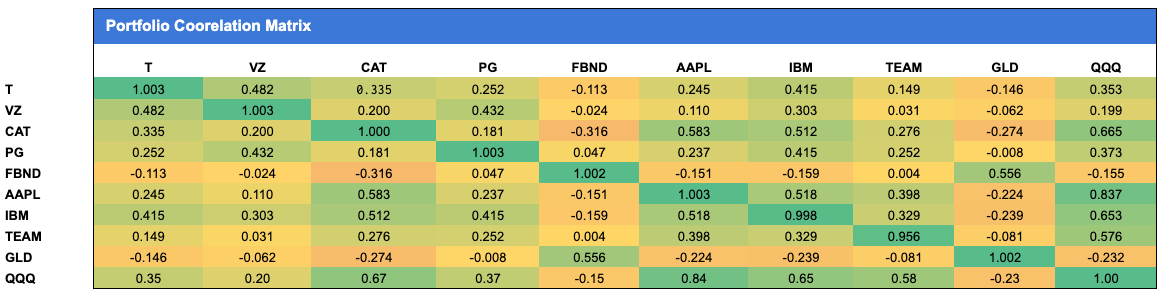

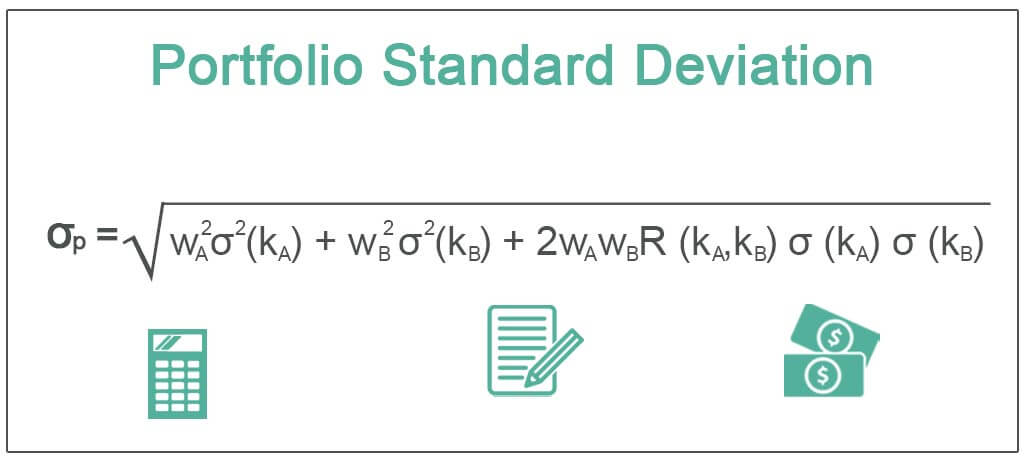

Web Portfolio variance is calculated using the standard deviation of each security in the portfolio and the correlation between securities in the portfolio.

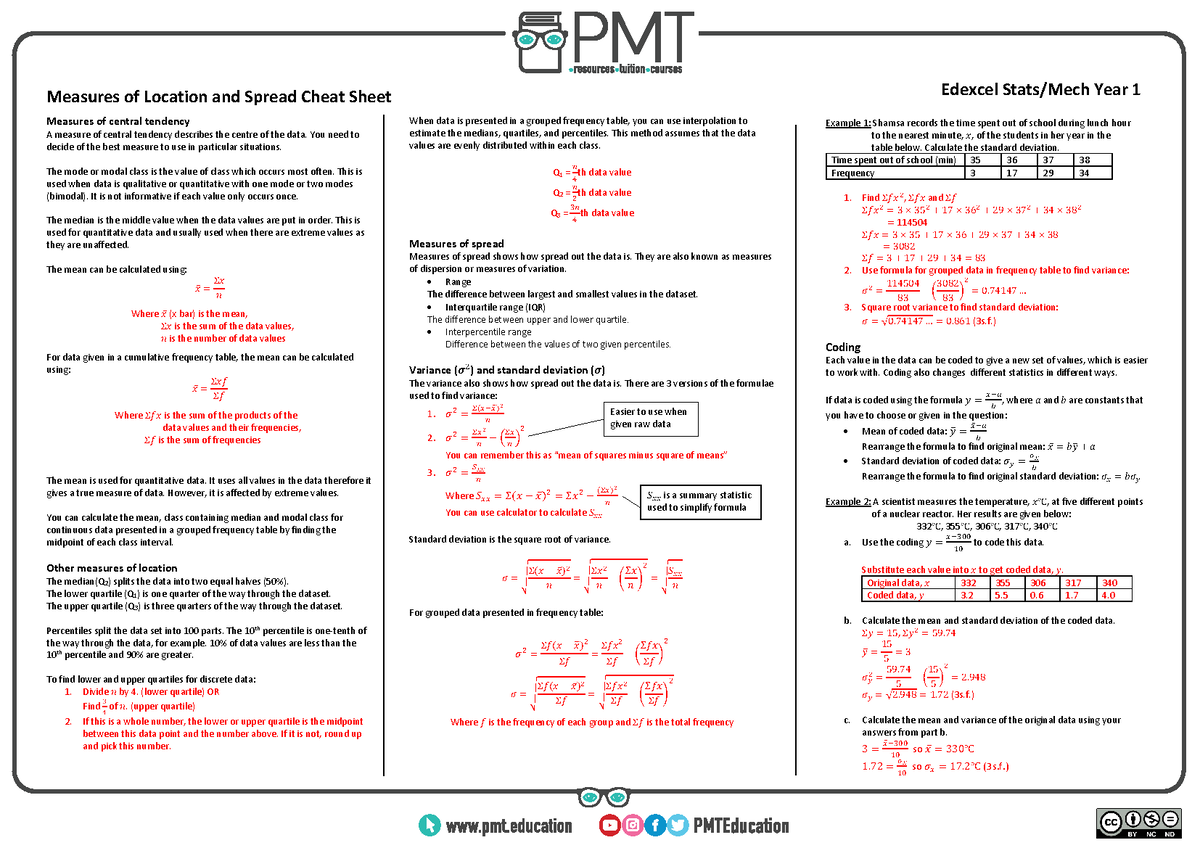

. Web Portfolio standard deviation is the standard deviation of a portfolio of investments. CV Standard Deviation σ Mean μ 192 6251. Web The portfolio standard deviation or variance which is simply the square of the standard deviation comprises two key parts.

Asset 2 makes up 31 of a portfolio has an. Web Portfolio A. Note that for the calculation of the variance for a.

It is a measure of total risk of the portfolio and an important input in. Ri Return on Respective Assets for Assets 1 to n in Portfolio. Total area under the curve is equal to 1.

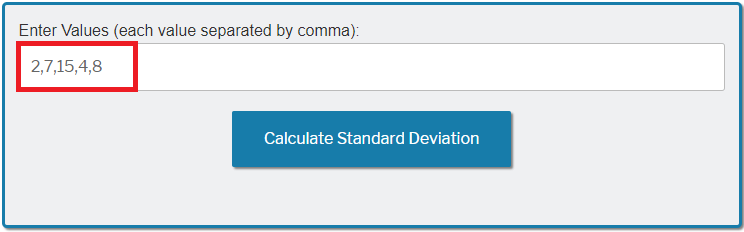

Fast facts at your fingertips indispensable financial reference and study. Web Standard deviation can be used to calculate a minimum and maximum value within which some aspect of the product should fall some high percentage of the time. You can also see the work peformed for the calculation.

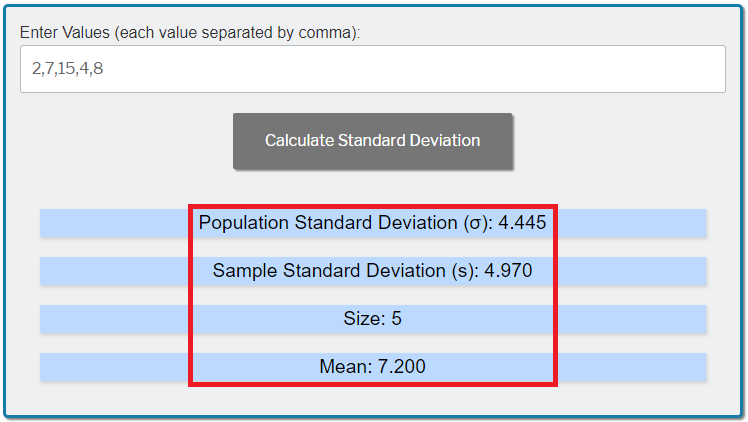

Web The standard deviation of the portfolio variance can be calculated as the square root of the portfolio variance. Web The variance calculator finds variance standard deviation sample size n mean and sum of squares. Every value is expressed as a percentage making it easier to compare the relative volatility of several mutual funds.

Medium Duration Fund. Web Asset 1 makes up 69 of a portfolio and has an expected return mean of 27 and volatility standard deviation of 9. Web Standard Deviation of a Two Asset Portfolio.

Calculate coefficient of variance. Web Standard Deviation of Portfolio Calculator helps calculating Standard Deviation of a portfolio including 2 assets Asset A Expected Return Standard Deviation Asset B. For each row in the.

Web σ 192. Web Return On Portfolio Three Securities Calculator Enter value and click on calculate. Enter a data set with.

Expected Return Dollar Amount. Expected Return Dollar Amount. 378 1134m Standard Deviation.

Web The standard deviation is 246. Result will be displayed. Six essential titles available in print format.

Web 29K views 9 months ago Calculating the portfolio standard deviation for 3 or more assets or positions means that you can then also calculate the portfolio VaR Value at Risk. The variance of the underlying assets. Web Portfolio Returns - The Expected Return Variance and Standard Deviation for the portfolios formed from Stocks 1 and 2 are displayed in this table.

Web However when each component is examined for risk based on year-to-year deviations from the average expected returns you find that Portfolio Component A. The relative variability calculation is popularly used in. Every value of variable x is converted into the corresponding z-score.

The fund has 9843 investment in Debt of which 3362 in Government securities 6481 is in Low Risk securities.

2 Asset Portfolio Calculator

How To Calculate The Standard Deviation Of A Portfolio 6 Steps

Standard Deviation Calculator Exploring Finance

Level I Volume 1 2018 Ift Notes Pdf Pdf Mean Probability Distribution

How To Calculate The Standard Deviation Of A Portfolio 6 Steps

How To Calculate The Standard Deviation Of A Portfolio 6 Steps

Ch 2 Measures Of Location And Spread Measures Of Central Tendency A Measure Of Central Tendency Studocu

How To Calculate The Standard Deviation Of A Portfolio 6 Steps

Ch 2 Measures Of Location And Spread Measures Of Central Tendency A Measure Of Central Tendency Studocu

Van Tharp S Sqn Indextrader

How To Calculate The Standard Deviation Of A Portfolio 6 Steps

Standard Deviation Calculator Exploring Finance

Portfolio Standard Deviation And Correlation Matrix Calculator In Google Sheets By John Mihalik Medium

Personal Finance Apex Cpe

Portfolio Standard Deviation And Correlation Matrix Calculator In Google Sheets By John Mihalik Medium

Portfolio Standard Deviation Formula Examples How To Calculate

Mean Variance Portfolio Performance 15 Writers